Late Payments Affect My Credit Score

It’s no secret that paying your bills on time is critical for credit scores. After all, payment history accounts for 35% of FICO scores, the most widely used credit score model for lending decisions. But sometimes life gets in the way of our best intentions—and a late bill payment can throw our credit scores off track. Here are a few things to keep in mind about how late payments affect your credit score.

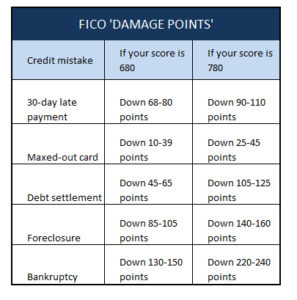

A missed payment can have a significant impact on your Credit Repair Coral Gables, but it can be a little different for each individual. The severity of the impact depends on a few factors, including how late you are and how long you remain delinquent on your debt. The impact of a late payment also decreases over time, and eventually it will drop off your credit report entirely.

The first time you miss a payment, it’s important to make up for the mistake and pay your past due balance as soon as possible to avoid being reported to the credit bureaus. In some cases, if you catch up with a bill before it goes 30 days overdue, your creditor may not notify the credit bureaus that it was a late payment. However, if you miss a payment by 30 or more days and then make it up, your creditor will likely report the late payment to the credit bureaus, and you could be charged a late fee.

How Do Late Payments Affect My Credit Score?

It’s also important to pay your current debts on time so they don’t go into collections. A late payment in collections can hurt your credit for up to seven years and can reduce your eligibility for new loans and credit cards. It can also make it more difficult to get approved for housing or a car, as lenders will view you as a high risk borrower.

One of the biggest reasons why it’s so important to pay your bills on time is that it demonstrates to lenders that you can manage your financial obligations. A good history of on-time payments shows you’re reliable, and it can help you qualify for lower interest rates and better terms on your loans. If you’re unable to pay your outstanding debts, contact your creditors immediately to see what their policies are about working out an arrangement. Most creditors are willing to negotiate with you and offer a workable solution.

Getting back on track with your credit is easy when you have an established record of on-time payments and a solid credit history. Try to establish some healthy financial habits and set up autopay on your credit cards so that you can pay them automatically every month. This will ensure you never miss a payment again! If you have already missed a payment and need assistance, the experienced team at ASAP Credit Repair can help. Our qualified credit repair experts can dispute inaccurate information on your credit report and help you restore your credit health. Contact us today for a free consultation!