Trade Carbon Market

Despite all the rhetoric and political talk about reducing greenhouse gas emissions, the United States does not yet have a regulated carbon market. In contrast, countries like China and Australia have established a cap and trade program that has reduced emissions by 10% since the program launched in 2013. In these markets, corporations are required to purchase credits to offset their own emissions. In the regulated market, these are called “carbon allowances” and only exist in jurisdictions with a carbon cap and trade program (such as California). In the voluntary market, which is currently much larger, these are known as carbon credits. The people that capture and sell these credits — farmers, foresters, and energy companies — make money off of the emissions reductions they provide.

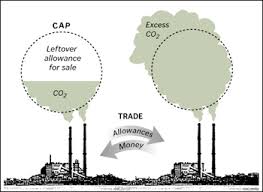

A trade carbon credits is a kind of permit that represents 1 ton of CO2 removed from the atmosphere. They are used to compensate for the emissions that come from industrial production, delivery vehicles or travel. Companies are double incentivized to reduce their emissions because, first, they must buy carbon credits to offset any emissions above a specified limit, and second, they can sell any extra credits they don’t need to other companies.

While most carbon credits are created through agricultural and forestry practices, they can also be generated through nearly any project that reduces, avoids, or destroys GHG emissions. The project must be independently verified by a third party to ensure that it actually produces the reductions it claims. This process is known as carbon accreditation.

Does the US Have a Trade Carbon Market?

The current voluntary carbon market is highly fragmented, with each carbon credit varying in attributes from the underlying project it was generated from to the region where it was produced. This inconsistency makes matching up a buyer with a seller a complex and time-consuming process that is often done over the counter. Increasing demand for carbon credits in the voluntary market has led to the creation of two new carbon exchanges, which attempt to simplify and streamline the process.

Both the Xpansiv CBL and ACX Exchange offer standard products that ensure certain specifications are met, such as the type of underlying project, a fairly recent vintage and certification from a limited set of standards. This helps to simplify the trading process and create a more efficient market.

Farmers who want to participate in the carbon market can do so through a variety of programs offered by private companies and nonprofits. Some of these are aggregators, which give farmers complete control over their projects and carbon credit sales in exchange for a fee or a percentage of the revenue. Other methods include using a data manager, where the farmer pays a company to manage and verify their data for them in return for a fee or revenue share.

Many companies do not have the technological ability to reduce their emissions to the point where they can earn a carbon credit. In these cases, they are looking to the compliance market to purchase credits in order to stay under their emissions caps. This is why the compliance market for carbon credits is so large, with 64 countries currently operating a cap and trade system.